Arizona Tax Rate 2025

Arizona Tax Rate 2025. 2023 new tax rate of 2.5% for all income levels and filing status the optional tax table and the x and y tax table are now obsolete. The flat arizona income tax rate of 2.5% applies to taxable income earned in 2023, which is reported on your 2024 state tax return.

Arizona tax brackets for 2022 income over $28,653 for single, and $57,305 for married filing jointly would be taxes at. Calculate your income tax, social security and.

The Freshly Adjusted Tax Rate, Down One Cent, Positions Chandler’s Combined Property Tax Rate At $1.0826 Per $100 Of Assessed Property Value For The Fiscal Year.

Opponents of the flat tax gathered signatures to place a referendum.

After Weeks Of Deliberations, Arizona Gov.

Doug ducey (r) this week signed into law a budget for fiscal year (fy) 2022 that reduces the state’s individual income tax.

Arizona Tax Rate 2025 Images References :

Source: taxfoundation.org

Source: taxfoundation.org

Arizona Lawmakers Deliver Tax Cuts and Federal Conformity, Combining general fund performance through march with the most current legislative forecasts, the state of arizona is on track to add more than $5.8 billion in new. For tax year 2023 and beyond, there are no optional or x&y tax.

Source: www.cheukying.com

Source: www.cheukying.com

美国各州企业所得税、个人所得税和消费税税率对比_卓盈企业管理有限公司, After weeks of deliberations, arizona gov. For all new residential leases starting on january 1, 2025, or later, the lease should not include rental taxes.

Source: itep.org

Source: itep.org

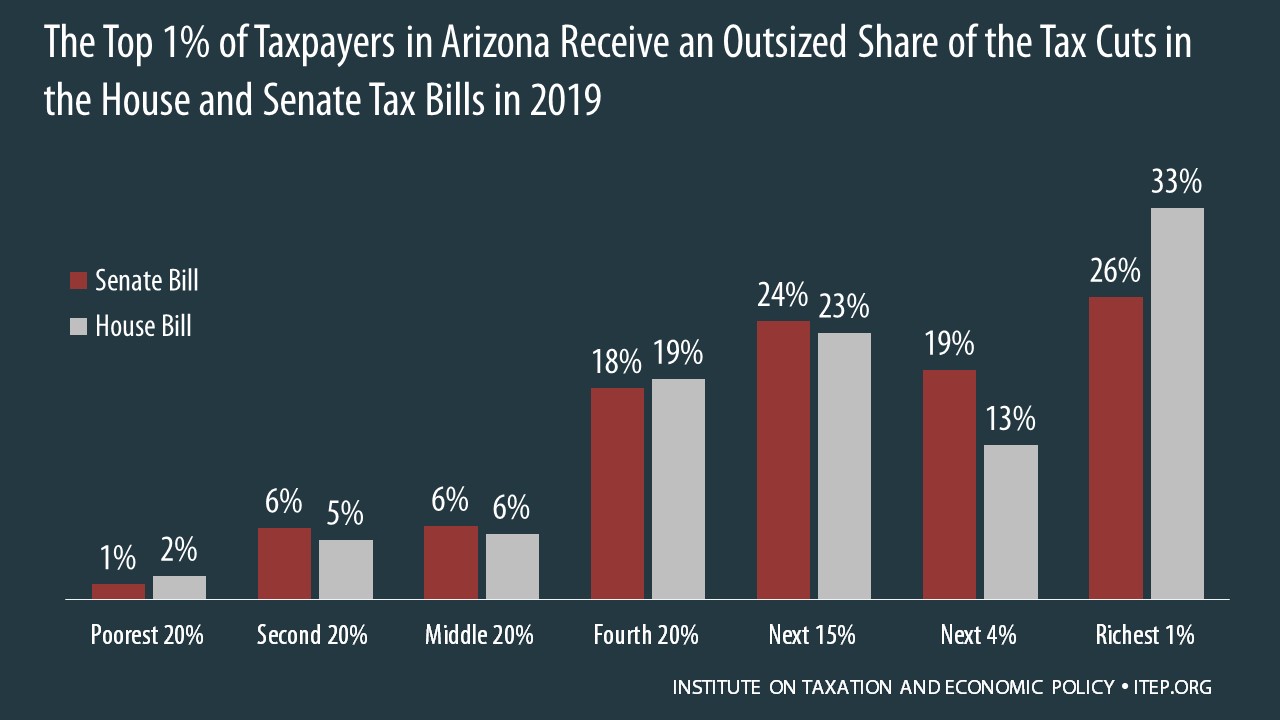

How the House and Senate Tax Bills Would Affect Arizona Residents, This flay income tax rate applies to arizona taxable. What are the arizona state tax brackets.

Source: itep.org

Source: itep.org

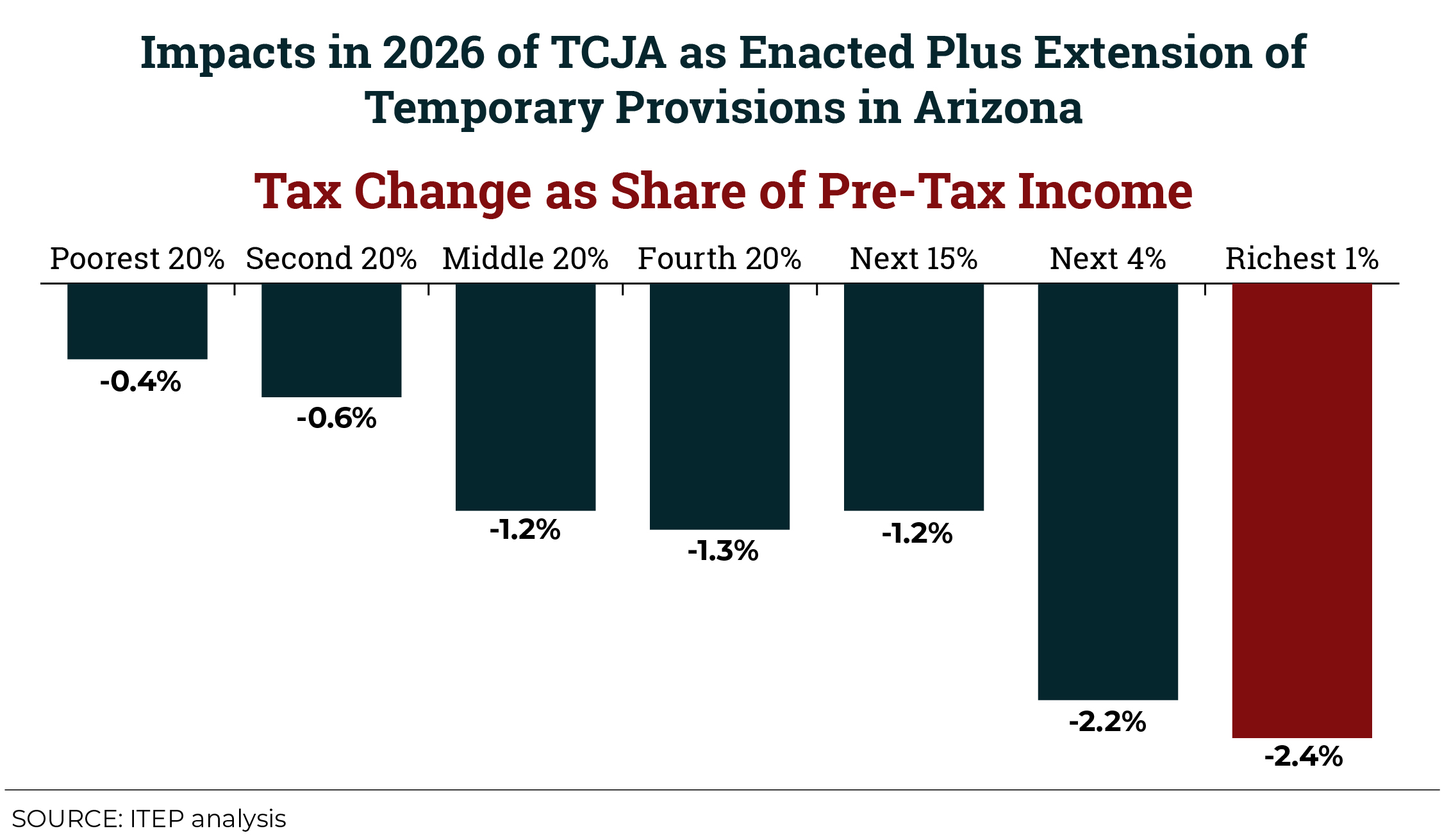

Tax Cuts 2.0 Arizona ITEP, Arizona charges a flat income tax of 2.50% on all income brackets and filing statuses. The due dates for your state income tax return.

Source: itep.org

Source: itep.org

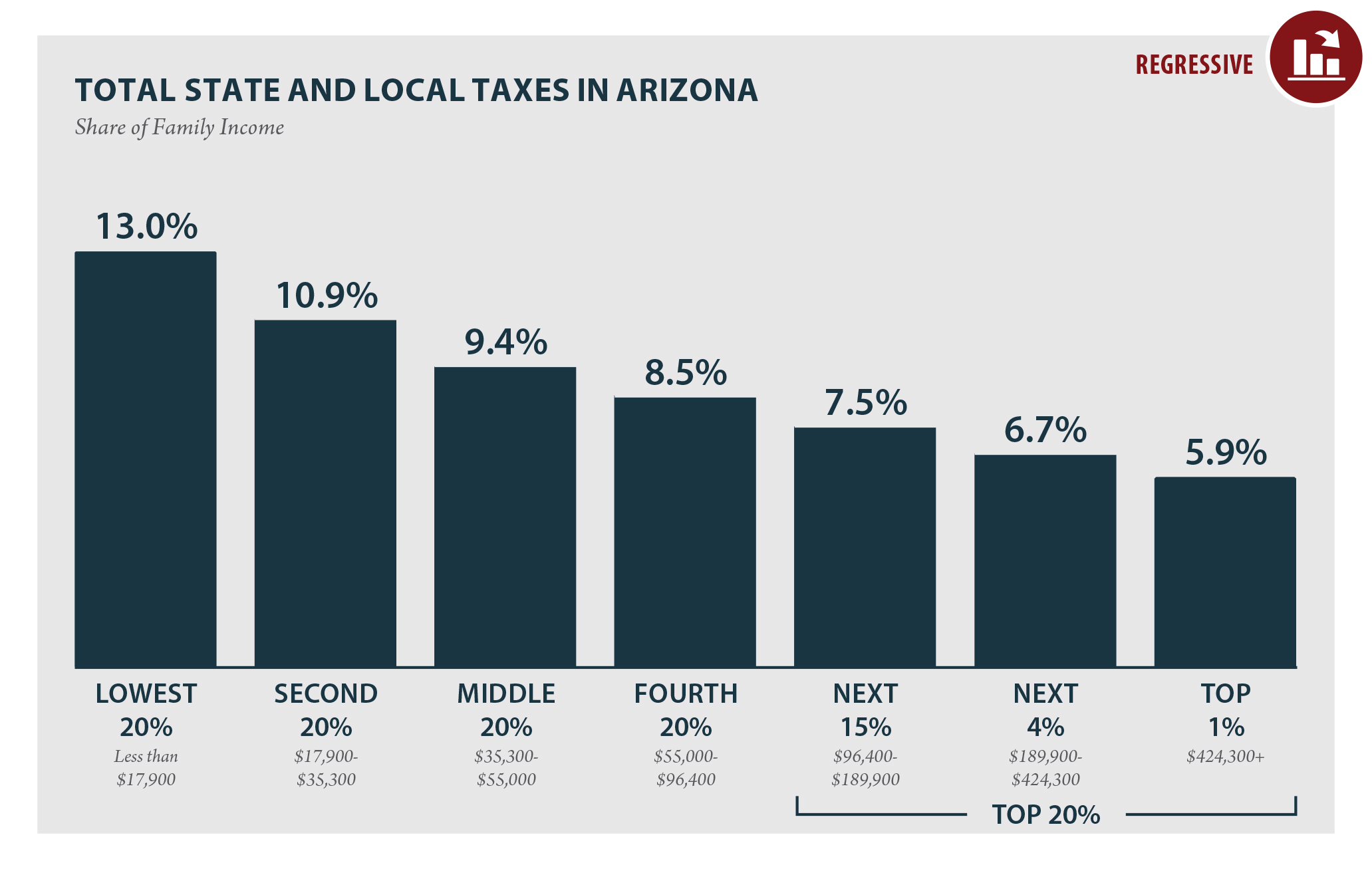

Arizona Who Pays? 6th Edition ITEP, Use our income tax calculator to estimate how much tax you might pay on your taxable income. New for the 2023 tax year, arizona has a.

Source: cronkitenewsonline.com

Source: cronkitenewsonline.com

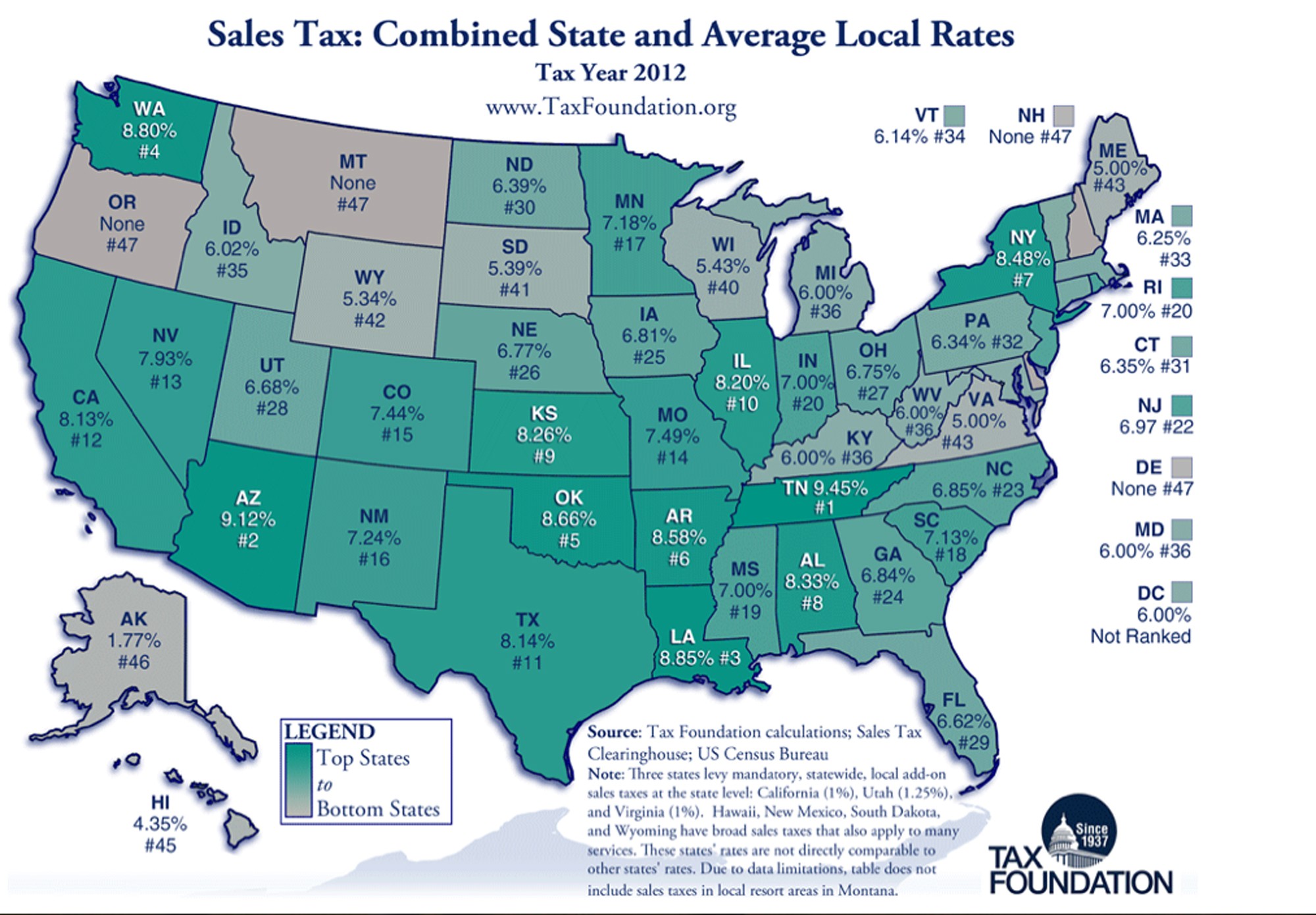

Arizona’s combined sales tax rate is secondhighest in the nation, Credit for contributions to private school tuition organizations (form 323) For all new residential leases starting on january 1, 2025, or later, the lease should not include rental taxes.

Source: www.actblogs.com

Source: www.actblogs.com

Evaluating Arizona Tax Rates And Rankings Key Considerations, The due dates for your state income tax return. Calculate your annual salary after tax using the online arizona tax calculator, updated with the 2024 income tax rates in arizona.

Source: www.bizjournals.com

Source: www.bizjournals.com

Arizona ranks low among states for tax burden, says Tax Foundation, 2024 tax calculator for arizona. After weeks of deliberations, arizona gov.

Az Dashboard Az Taxes, Calculate your annual salary after tax using the online arizona tax calculator, updated with the 2024 income tax rates in arizona. Doug ducey (r) this week signed into law a budget for fiscal year (fy) 2022 that reduces the state’s individual income tax.

.png) Source: taxfoundation.org

Source: taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates, 2023 new tax rate of 2.5% for all income levels and filing status the optional tax table and the x and y tax table are now obsolete. Arizona also has a 5.6 percent state sales tax rate and an average combined state and local sales tax rate of 8.38 percent.

Arizona Now Has A Flat Tax Rate Of 2.5% For Tax Year 2023.

Arizona also has a 5.6 percent state sales tax rate and an average combined state and local sales tax rate of 8.38 percent.

The Due Dates For Your State Income Tax Return.

Credit for contributions to private school tuition organizations (form 323)

Posted in 2025