Ca De4 2024

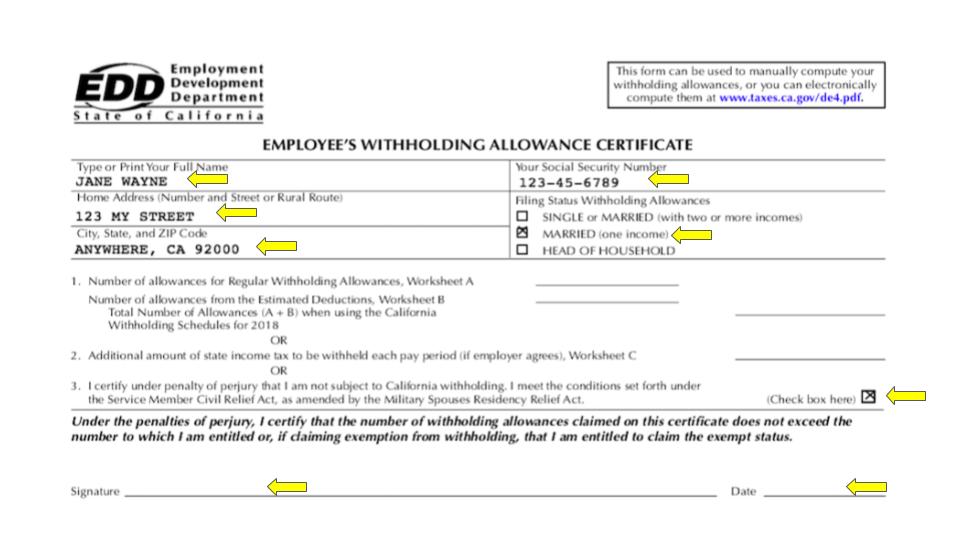

Ca De4 2024. California’s withholding methods will be updated for 2024, an official from the state employment development department said oct. Accountant, shannon, reads and explains the instructions for the california de4 form (employee's withholding allowance certificate).

To 10:00 p.m., pacific time, due to scheduled maintenance. Calculate and withhold 7% of nonwage payment more than $1,500 in a.

This California Form Is Vital For Employees To Indicate Their State Withholding Allowances And.

However, with the passing of senate bill 951, employees earning above that income will be taxed as well.

Effective January 1, 2024, Senate Bill (Sb) 951 Removes The Taxable Wage Limit.

To 10:00 p.m., pacific time, due to scheduled maintenance.

California’s Withholding Methods Will Be Updated For 2024, An Official From The State Employment Development Department Said Oct.

Images References :

Source: www.formsbank.com

Source: www.formsbank.com

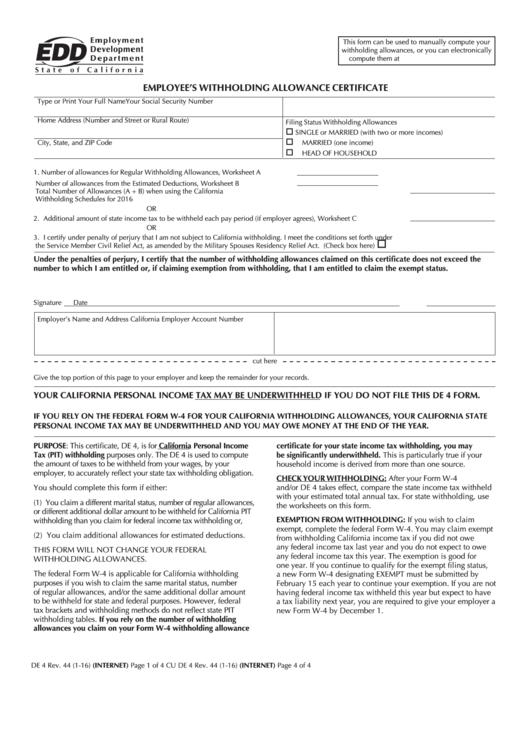

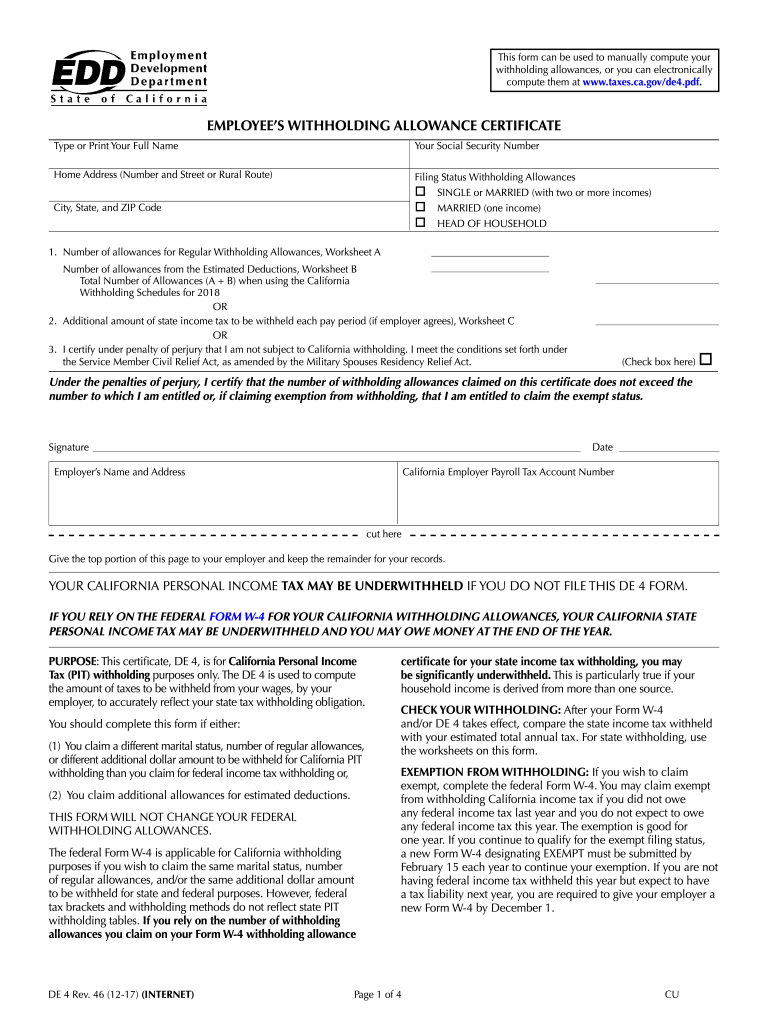

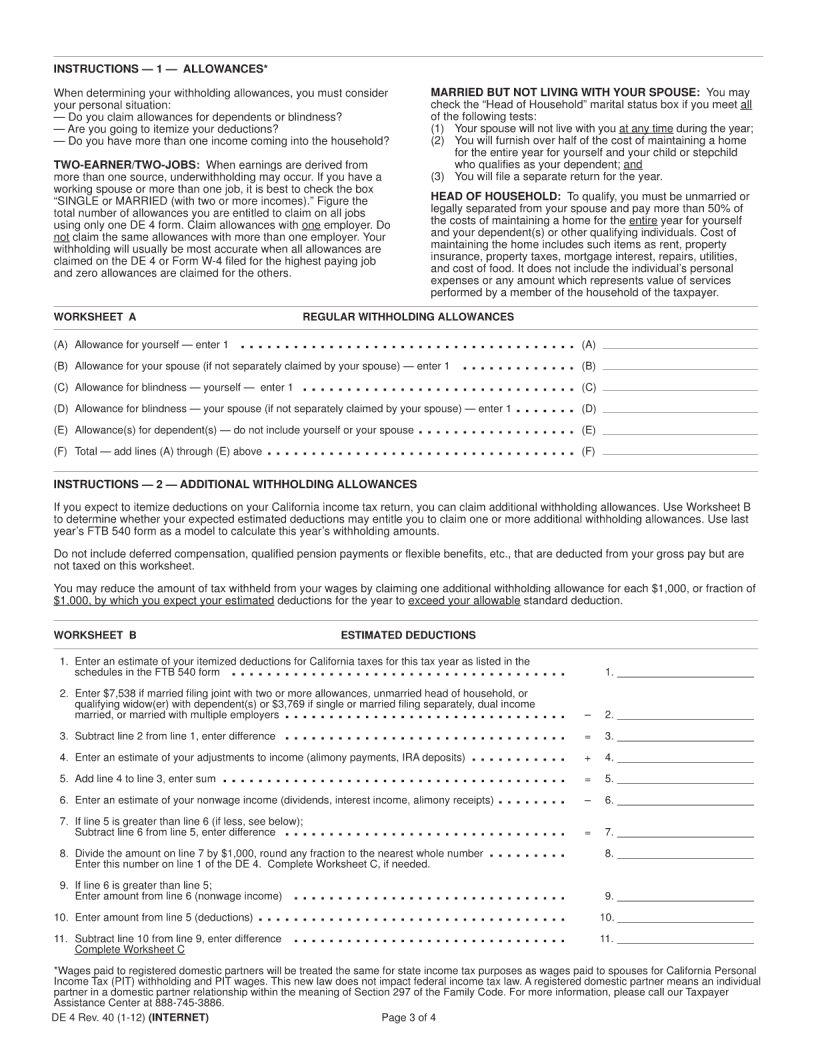

Fillable Form De 4 Employee'S Withholding Allowance Certificate printable pdf download, This form, submitted quarterly, allows the edd to accurately track wages, tax payments, and benefits eligibility for workers within the state. The sixth meeting of the bilateral dialogue on raw materials established under article 25.4 of the comprehensive economic and trade agreement (ceta) took place in.

Source: www.youtube.com

Source: www.youtube.com

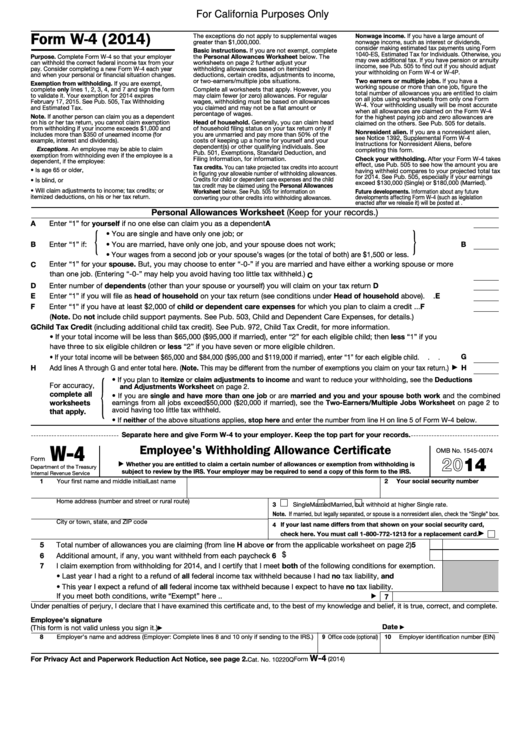

Accountant Reads California DE4 Instructions YouTube, Backup withholding (resident and nonresident withholding) backup withholding is a type of income tax withheld on specific income types when a payee fails to: However, with the passing of senate bill 951, employees earning above that income will be taxed as well.

Source: www.signnow.com

Source: www.signnow.com

Ca De4 20172024 Form Fill Out and Sign Printable PDF Template signNow, Withholding requirements for a nonresident. Single or married (filing separately, with 2 or more incomes) married (filing together, 1 income) head of.

Source: www.vrogue.co

Source: www.vrogue.co

Form De 4 California Employee Withholding 2023 Employeeform Net Vrogue, Withholding requirements for a nonresident. Posted on march 12, 2024.

Source: fill.io

Source: fill.io

Fill Free fillable De4 Employee's Withholding Allowance Certificate (DE 4) PDF form, For every nonwage payment you make, you must: This california form is vital for employees to indicate their state withholding allowances and.

Source: www.alfredmatthews.com

Source: www.alfredmatthews.com

New 2024 Black GMC Terrain AWD 4dr AT4 For Sale in MODESTO Manteca Dealerships Dublin CA GMC, Prominent boxing promoter eddie hearn has recently stirred the pot further, suggesting that tensions could escalate when canelo and de la hoya next meet. Only need to adjust your state withholding allowance, go to the.

Source: icalendrier.fr

Source: icalendrier.fr

Calendrier 2024 à imprimer PDF et Excel iCalendrier, Single or married (filing separately, with 2 or more incomes) married (filing together, 1 income) head of. Calculate and withhold 7% of nonwage payment more than $1,500 in a.

Source: formspal.com

Source: formspal.com

Ca De 4 Form ≡ Fill Out Printable PDF Forms Online, Backup withholding (resident and nonresident withholding) backup withholding is a type of income tax withheld on specific income types when a payee fails to: The sixth meeting of the bilateral dialogue on raw materials established under article 25.4 of the comprehensive economic and trade agreement (ceta) took place in.

Source: www.ingramfinancialmanagement.com

Source: www.ingramfinancialmanagement.com

How to Complete Forms W4 Attiyya S. Ingram, AFC®, MQFP®, Accountant, shannon, reads and explains the instructions for the california de4 form (employee's withholding allowance certificate). Calculate and withhold 7% of nonwage payment more than $1,500 in a.

California DE4 App, Credit card services may experience short delays in service on wednesday, may 1, from 7:00 p.m. To 10:00 p.m., pacific time, due to scheduled maintenance.

Registration Now Open For 25Th Annual Sustainability Awards Event.

Prominent boxing promoter eddie hearn has recently stirred the pot further, suggesting that tensions could escalate when canelo and de la hoya next meet.

Meet The Nbc Broadcast Team Larry Collmus Has Been The Voice Of The Kentucky Derby Since 2011 When He Took Over For.

To 10:00 p.m., pacific time, due to scheduled maintenance.